Quick Navigation

Flood insurance exists to help homeowners restore their properties after major floods.

The average annual cost of flood insurance in New Jersey is around $963. However, many factors can affect the overall flood insurance cost. Private insurance providers and government insurances also have different calculations for the flood insurance of a property.

Understand more about how flood damage can affect you by learning about flood insurance in New Jersey below.

Average Cost of Flood Insurance in New Jersey

Most property owners in the US obtain flood insurance through the National Flood Insurance Program (NFIP).

According to the NFIP, their flood insurance costs range from $330.00 to $1,184.00 per year. This vast range has left many property owners wondering exactly how much flood insurance is in NJ. A short answer to this would be: it depends on the city your property is located in.

For example, property owners in Long Beach can expect an average annual cost of $1,023. At the same time, those in Edgewater generally pay $330.00 per year.

The following factors cause this vast gap between flood insurance rates:

- Location of the property

- Risk Rating

- Type, size, and age of the property

- Deductible amount from flood policies

- Coverage of the flood insurance

We’ll discuss these factors in detail later on. Still, the main contributors to flood insurance costs are the property location and risk rating.

Two differently sized properties in the same flood zone may pay the same rate. That’s because specific insurance policies dictate that properties with the same flood risk must pay the same amount.

Of course, this is still dependent on the flood insurance provider. Some private homeowners insurance uses more advanced calculations to price their flood insurance. This can include using computer flood models to determine the property’s flood risk accurately.

Factors that Affect the Cost of Your Flood Insurance

NFIP and private flood insurance companies generally use the same criteria to calculate the cost of flood insurance.

Location of the Property

Properties located in identified flood zones generally have higher flood insurance costs.

According to data from the NFIP, flood zones are categorized into two types, each with a corresponding average annual cost:

- High Risk – $1,026.00

- Moderate to Low Risk – $637.00

You can identify whether your property is located within a flood zone and, if yes, the type it falls under by consulting the NFIP’s Flood Map Service Center. High-risk areas are symbolized as A or V, while Moderate to Low Risk is symbolized as B, C, or X.

Knowing the exact location of your property gives you a general idea of how much flood insurance is in NJ.

FEMA’s Risk Rating 2.0

The newly implemented Risk Rating 2.0 has changed 95% of flood insurance rate calculations.

The Risk Rating 2.0 is a new system created by FEMA to determine a property’s flood risk. The NFIP currently uses this system. It complies with information on local topography, sources of flooding, and other crucial data to accurately determine a property’s flood risk. [1]

These changes may mean that properties originally not designated on a flood zone may now be designated as one and vice versa. Flood insurance rates may decrease or increase depending on these changes.

Type, Age, and Construction of the property

Residential and commercial properties have different flood insurance costs. [2]

Homeowners’ insurance is generally cheaper than commercial properties. Commercial flood policies include more liability insurance. Additional coverage for operations, products, and operations liabilities is considered for commercial properties. This racks up higher flood insurance costs compared to residential properties.

Older properties generally have higher flood insurance costs.

Older properties are typically constructed without modern flood mitigation features such as flood openings and barriers. Modern properties may also be affected if they aren’t up-to-date with floodproofing standards.

The property’s elevation from the mean sea level is also considered.

Properties with lower floors, such as those with multiple basement levels, are at higher risk for flooding. The depth of the property’s lowest floor is compared with the expected water level to calculate the susceptibility to flooding. Generally, the lower the property’s lowest floor, the higher the flood insurance cost.

Deductible Amount from Flood Policies

Deductibles are the amount you need to pay before insurance covers the claim.

To illustrate the effect of deductibles, on a $60.00 deductible, you only need to pay the first $60.00 for your insurance to cover the rest. Higher deductibles mean lower flood insurance costs, but it also means paying more to claim for flood damages. Lower deductibles mean more flood insurance premiums.

Flood insurance policy varies by city in New Jersey. Locations like Stow Creek have only one flood insurance policy, while others like Ocean City have up to 15,531.

New Jersey Flood Insurance Coverage

Property owners can choose the level of coverage provided by their flood insurance.

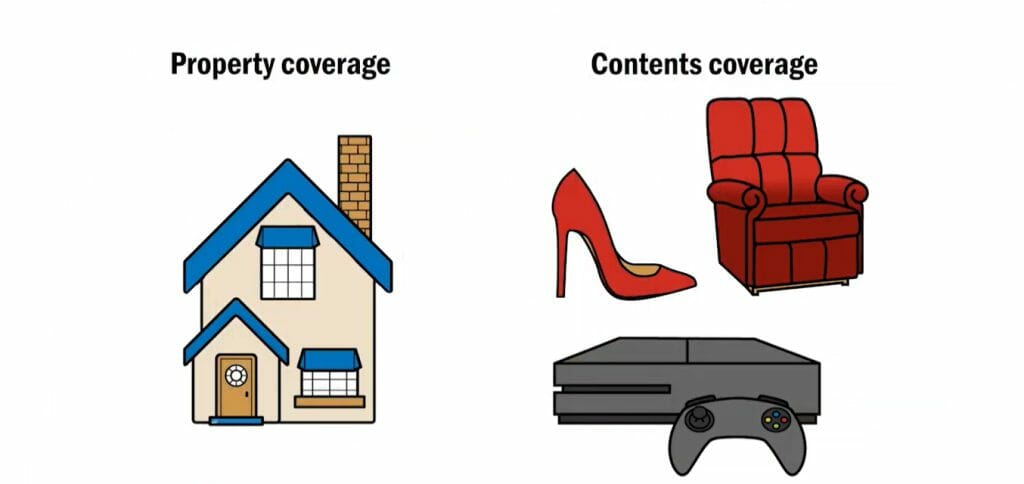

In particular, the national insurance program comes with two primary coverages you can buy together or individually. These are the building property coverage and the personal property coverage.

The NFIP covers up to $250,000 for the structure of the property. This includes the following:

- Roof

- Exterior walls

- Plumbing and electrical systems

- Cooling and Heating Systems

- Exterior Garages

- Debris Removal

- Built-in Appliances

The NFIP covers up to $100,000 for selected personal belongings. This includes the following:

- Clothing

- Furniture

- Electronics and Portable Appliances

- Portable Heating and Cooling Systems

- Books

Please take note that each coverage has its own set of deductibles. In addition, the amount indicated on each cover is the maximum amount the NFIP will reimburse regardless of the actual damage costs.

The NFIP flood insurance does not cover the following:

- Damages to the structure and personal property caused by mold, moisture, and mildew

- Currency and other valuables

- Furniture and belongings outside of the property

- Furniture and belongings inside the basement

NFIP Coverage or Private Flood Insurance

Property owners in New Jersey can choose between NFIP coverage or private insurance companies.

Private insurance companies can cover more significant amounts than the NFIP. Also, they typically include certain coverages and perks that the NFIP does not provide. Examples are ‘loss of use coverages’ that cover temporary lodging and meals and ‘replacement cost coverages’ for personal belongings.

The availability waiting period for the insurance to take effect is another important consideration.

National flood insurance is available for every county and city within New Jersey. All property owners can have their properties assessed for flood insurance and receive it without much trouble. But the waiting period for a claim to take effect is 30 days.

Private insurance companies can deny certain applicants, limiting it to only those within high-risk areas. On the other hand, private companies are not restricted by the red tape on government agencies. Their waiting period for claims can be as little as two weeks.

Wrapping Up

It is strongly advised to get flood insurance for your New Jersey property.

Water damage caused by flooding is generally not covered by homeowners insurance policies. Adding flood insurance can give owners peace of mind that their property will be in safe hands.

Take a look at some of our related articles below.

References

[1] Risk Rating 2.0-Flood in Action – FEMA – www.fema.gov/flood-insurance/risk-rating

[2] The Difference Between Commerical and Residential Insurance – Raizner Slania LLP – www.raiznerlaw.com/blog/the-difference-between-commercial-and-residential-insurance/

Video References

CNBC

FEMA

REtipster

Andrew Craven